New Managing Director for Bellona Norway

The Board of the Bellona Foundation has appointed former Minister of Climate and the Environment Sveinung Rotevatn as Managing Director of Bellona No...

News

Publish date: January 20, 2003

Written by: Zackary Moss

News

In readiness for the release of an Energy White Paper this spring and the establishment of the Liabilities Management Authority, or LMA, this year, Britain’s Labour Party is preparing to underwrite all nuclear waste management liabilities from British Nuclear Fuels Limited, BNFL, and British Energy Plc. This will transfer £7.1bn in liabilities to the British taxpayer and amounts to nothing more than a subsidy to Britain’s ailing nuclear industry.

Long-term liabilities

Nuclear fission generated electricity produces waste that remains highly-radioactive for hundreds of thousands of years. The reprocessing of spent nuclear fuel — which separates out unused uranium and plutonium — produces additional waste.

The costs in storing and managing radioactive waste are long-term liabilities included in company balance sheets. Because these costs mature in the future, they are reduced — or discounted — to reflect the fact that funds set aside would earn interest and be worth more than needed to cover costs. This is known as discounting and reduced costs are discounted costs. Assets, such as power stations, fall in value when they near the end of their lives. When this happens the discounted value of liabilities rises because less time remains for the money set aside to earn interest.

Financial legacy

Nuclear power generators should set aside adequate funds to cover their future liabilities. But they have not and the total cost of dealing Britains nuclear waste problem is estimated to be £60bn (undiscounted) by a Friends of the Earth Press Briefing, Liabilities — Labours Hidden Subsidy to Nuclear Power, released January 2003.

BNFLs undiscounted liabilities were estimated by the Department of Trade and Industry (DTI) report Managing the Nuclear Legacy-A strategy for action to be £40.5bn. Despite BNFLs assets — including contracts with foreign customers and the British Ministry of Defence — these are not sufficient to cover future liabilities and as a result, BNFLs discounted liabilities are £3.8bn more than available assets, a figure confirmed in its 2001 Annual Report.

In 1997 British Energys undiscounted liabilities stood at £12.9bn, although the 2001/2 Annual Report states discounted liabilities are £3.7bn. After British Energy was privatised in 1996, it was required to set up a Nuclear Decommissioning Fund, or NDF, to pay for the decommissioning costs of reactors. While the NDF is worth some £411m, British Energy has made no additional provisions for liabilities. Moreover, a company statement to shareholders made on November 28th confirms that British Energy has a £3.3bn shortfall in funds.

According to the DTI, the UKAEAs undiscounted liabilities are £7.4bn, although these are covered by the DTI and the Ministry of Defence.

A helping hand

Given the need to ensure waste is stored and managed safely, any government faced with nuclear industry problems must be ready to underwrite their liabilities.

In July last year the DTI published the White Paper "Managing the Nuclear Legacy-A strategy for action", which set out plans for the management and clean-up of the UKs civil nuclear legacy including the creation of the LMA.

According to the DTI, the LMA will be responsible to the government with a specific remit to ensure that nuclear clean-up is carried out safely, securely, cost effectively and in ways that protect the environment for the benefit of current and future generations. The White Papers consultations ended on October 18th.

The establishment of a LMA, expected this year, and the transfer of assets and liabilities from BNFL and UKAEA to it, will require primary legislation. DTI Secretary Patricia Hewitt has promised to publish a draft Bill to set up the LMA this Parliamentary session.

In the meantime, though, the DTI has established a new Liabilities Management Unit (LMU). The LMU will work with BNFL, UKAEA and the nuclear regulators in helping to prepare the ground for the LMA.

Until then, BNFL will continue to run the Sellafield reprocessing plants, the £460m MOX plant and Magnox reactors, although ownership of sites and liabilities will eventually be transferred to the LMA.

Thank you taxpayer

The combined undisclosed liabilities of BNFL and British Energy are £7.1bn, which will soon be erased from their balance sheets and transferred to the taxpayer.

Because BNFL is a state-owed concern, British ministers argue that its transfer to the LMA would have no effect on public finances. Yet the elimination of its £3.8bn asset-liability deficit might not act as an incentive to BNFL to be less risky in future ventures. Moreover, the governments proposals may not prevent BNFL from investing its profits in risky ventures or from borrowing money to invest in new nuclear power plants, which would produce more waste.

The same is true of British Energy, especially as the British government has pledged to underwrite the cost of meeting the companys liabilities, which will cost the taxpayer £150mn-£200m a year. Besides, British Energys solvent restructuring package — announced by Mrs Hewitt on November 28th — leaves the company free to do as it pleases with 35% of its free cash flow not earmarked for liabilities.

But will the LMA make BNFL and British Energy accountable for their future ventures and waste management operations?

The answer to this question depends on whether the LMA is structured in such a way that ensures there is sufficient economic pressure on the nuclear industry to minimise waste. If the LMA follows the "polluter pays principle", there is an economic incentive for nuclear generators to reduce waste levels.

In a telephone interview with Bellona Web Monday, Derek M Taylor, Head of Nuclear Energy at the European Commission’s Directorate-General for Energy and Transport, commenting on the LMA, said: hopefully the LMA will incorporate the [less waste, less cost] approach which should keep up the economic pressure on industry to minimise the quantity of waste it produces and therefore the cost it has to pay.

"Although the big costs relate to historical liabilities, there is no reason for the LMA to act in a way that would increase waste, as this would increase the nuclear industry’s costs, Mr Taylor continued.

New plants on the horizon?

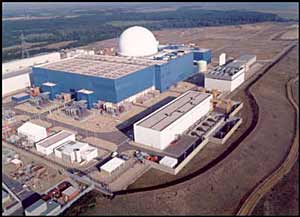

Waste issues aside, Mrs Hewitt will still have to make a decision on the future of nuclear plants. This is because the UKs 31 nuclear reactors — which provide 25% of electricity demands — are aging. In fact, older Magnox reactors are due to close in 2010 and Britains newest reactor, a pressure water reactor at Sizewell B, will close by 2024.

Yet Mrs Hewitt has neither confirmed nor denied the possibility that some new nuclear power stations might have to be built to meet the UKs energy needs, although no decision is expected until after the White Paper is published in February or March.

Supporters of nuclear power — including pro-nuclear Energy Minister Brain Wilson — maintain it is crucial for energy security of supply, and that nuclear powers zero carbon emissions make up for environmental hazards it poses.

However, the financial woes of Britains nuclear industry have persuaded Mr Wilson to introduce a five-year moratorium on the building of new nuclear power stations. Indeed, Mr Wilson is expected to announce in the not too distant future that there are no plans to back any new nuclear projects until at least 2008.

The Board of the Bellona Foundation has appointed former Minister of Climate and the Environment Sveinung Rotevatn as Managing Director of Bellona No...

Økokrim, Norway’s authority for investigating and prosecuting economic and environmental crime, has imposed a record fine on Equinor following a comp...

Our op-ed originally appeared in The Moscow Times. For more than three decades, Russia has been burdened with the remains of the Soviet ...

The United Nation’s COP30 global climate negotiations in Belém, Brazil ended this weekend with a watered-down resolution that failed to halt deforest...