Arctic Frontiers: Disinformation, Security and the Northern Sea Route

Bellona held a seminar on countering Russian disinformation in the Arctic at the Arctic Frontiers international conference in Norway

News

Publish date: October 2, 2002

Written by: Zackary Moss

News

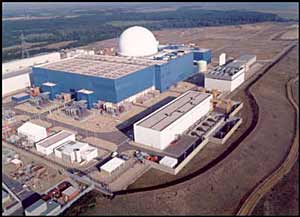

British Energy — which operates 15 of Britain’s 31 nuclear reactors, including 14 advanced gas-cooled reactors and Britain’s newest reactor, a single pressure water reactor, completed in 1995, employs 5,200 staff and provides 20% of Britain’s total electricity supply — blames its financial difficulties on a liberalised energy market that favours non-nuclear producers of electricity, as well as crippling clean-up costs imposed on it by British Nuclear Fuels Limited (BNFL).

The decision to allocate £650m of British taxpayers’ money to save British Energy from bankruptcy comes after managers had reassured investors in mid-August that the company was in good financial health. The managers also paid shareholders a large dividend — a decision British ministers were said to be furious with after the same managers appealed for government aid on September 5th. Moreover, Britain’s financial watchdog, the Financial Services Authority, has launched an investigation into whether British Energy has misled investors.

Tough competition in a liberalised energy market

In comparison to European electricity generation, Britain has a fairly liberalised energy market. Britain’s energy policy is concerned with the production of cheap power. Privatisation and liberalisation in the 1990s encouraged the building of cheap gas-fired power stations, translating the reduced costs of electricity generation into cheaper prices for businesses and households. While the energy market now favours the customer, the consequence of energy liberalisation is that energy wholesale prices have fallen by around 40% since 1998. At the current wholesale price of £16 per megawatt hour, British Energy, producing at £19, makes a £3 loss — an activity that hardly justifies British Energy’s operation, never mind it paying shareholders handsome dividends.

Besides, nuclear operators have additional costs to meet. According to an article in The Economist on September 14th, “energy liberalisation has exposed the true costs of nuclear power, and of the political burdens which the British government has chosen to impose on British Energy”. British Energy must pay a total of £300m annually for its spent nuclear fuel (SNF) to be reprocessed at Sellafield, operated by the state-owned BNFL. But until Britain’s nuclear industry has a long-term storage facility for SNF, reprocessing will keep BNFL in business. British Energy would like to store SNF as this would be cheaper than reprocessing, as done in most other countries with nuclear power plants.

Another financial burden for nuclear generators is the payment of a carbon-based tax aimed at reducing CO2, although nuclear generators actually produce no CO2 emissions. Currently, British Energy must pay £80m annually in tax towards this end. The British government maintains that this tax is designed to encourage renewable energy, rather than penalise carbon-emitting energy producers. Nuclear generators must pay higher rates — local taxes — than their non-nuclear competitors. But perhaps the largest financial burden for nuclear power generators are the huge future decommissioning costs they must pay.

A less than bright future for British Energy

Despite the relatively high operating costs of British Energy, it is feasible that nuclear generators could operate competitively in a liberalised energy market. In a telephone interview with Bellona Web on October 1st, Derek Taylor, Head of the European Commission’s Directorate-General for Energy and Transport, commented that nuclear generators could in fact compete quite successfully. “This is largely dependent on a company’s control of operating costs and future liabilities, and whether or not it is well managed”, he said. Mr Taylor also said that some nuclear generators in Europe had in the past competed successfully in the energy market. “If properly operated there is no reason why nuclear generators cannot compete in a liberalised energy market”, he said. In his option, British Energy’s troubles stem mainly from privatisation’s failure to account properly for future liabilities, the imposition of the CO2 tax and BNFL’s reprocessing fees.

Even if nuclear generators could operate competitively, British Energy’s high fixed costs and poor management mean that this might not be a good example for the industry to follow. Nevertheless, the decisions already taken by Patricia Hewitt, secretary of the Department of Trade and Industry, means that the British government seems prepared to stand by British Energy on the grounds that letting the company go bankrupt would put in jeopardy Britain’s energy needs. In truth, there is sufficient capacity in Britain’s energy infrastructure to let British Energy go bankrupt and shutdown its reactors, though this is unlikely to happen immediately. Nuclear generators throughout the European Union will be waiting for the outcome on November 29th before they decide to bid for British Energy. But given the past experience of the British government, it is likely that the company will be saved from bankruptcy until a long term solution is found.

The idea that a government supporting energy liberalisation would be willing to stand by British Energy is an odd one. Still, the British taxpayer should be asking whether more money should be used to support an ailing private company that was until recently in good financial health and paying its shareholders large dividends.

Bellona held a seminar on countering Russian disinformation in the Arctic at the Arctic Frontiers international conference in Norway

Our December Nuclear Digest, reported by Bellona’s Environmental Transparency Center, is out now. Here’s a quick taste of three nuclear issues arisin...

Bellona has launched the Oslofjord Kelp Park, a pilot kelp cultivation facility outside Slemmestad, about 30 kilometers southwest of Oslo, aimed at r...

Our November Nuclear Digest by Bellona’s Environmental Transparency Center is out now. Here’s a quick taste of just three nuclear issues arising in U...